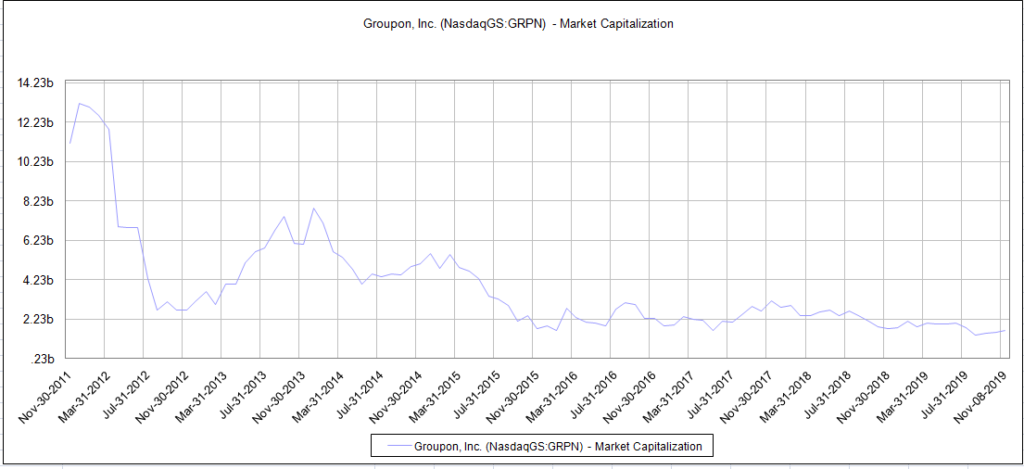

The coupon company’s share price has struggled since their IPO

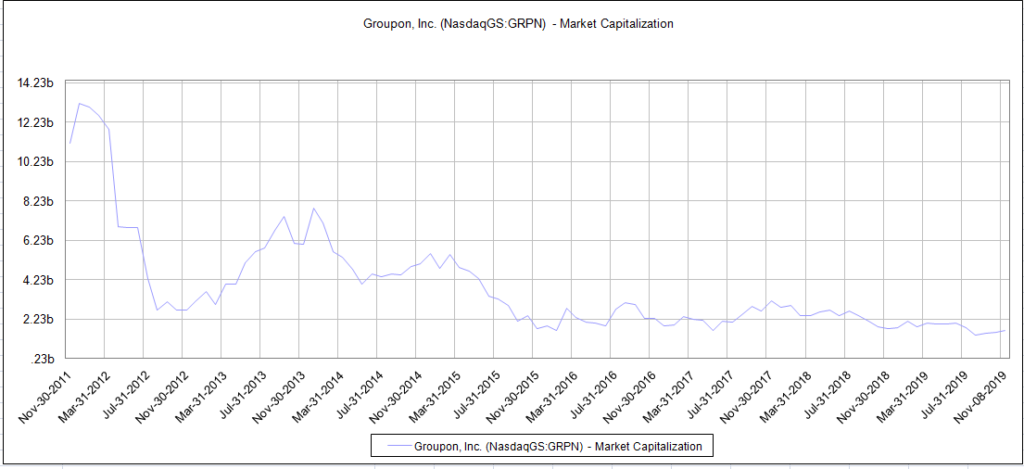

The coupon company’s share price has struggled since their IPO

Restaurant chains from Starbucks Corp. to Shake Shack Inc. have reported slowing or falling traffic in recent quarters, as changing consumer behaviors catch up with them. Consumers are increasingly eating at home or the office to save money and time, particularly at lunch. People are also shopping more online, and making fewer trips to restaurants near malls.

Potbelly said nearly 60% of its business comes at lunch, and that it is looking at ways to attract more customers at other times. Potbelly competes in a crowded market.

The pizza chain that helped popularize delivery is keeping its pies off other services that allow diners to order all manner of cuisines to their doors.

Delivery has become one of the most divisive issues in the restaurant industry, promising to boost sales at the expense of profit margins. Some companies have pushed for better service and more favorable terms than the 25% of a restaurant’s profit that delivery companies typically take for each order they deliver.

Domino’s Pizza Inc. is one of the largest chains to stay off the new third-party delivery apps altogether. The company relies on its own employees to make deliveries from its 6,000 U.S. stores and most of its 11,000 international ones, and it runs its own online-ordering app. Chief Executive Ritch Allison said the profit hit and reputational risk of working with delivery companies isn’t worth the extra sales.

“As profit is extracted from the industry, I think we’re going to see a lot of players really struggle,” Mr. Allison said in an interview.

The problem is getting them to visit in the afternoon. Starbucks is among major coffee chains in the U.S. that cite the increasing importance of attracting customers in the hours between lunch and dinner. The chains get about 59% of their traffic in the morning, and while they get a smaller amount in the afternoon—23%—it is a sizable and growing business, according to market research firm NPD Group Inc.